-

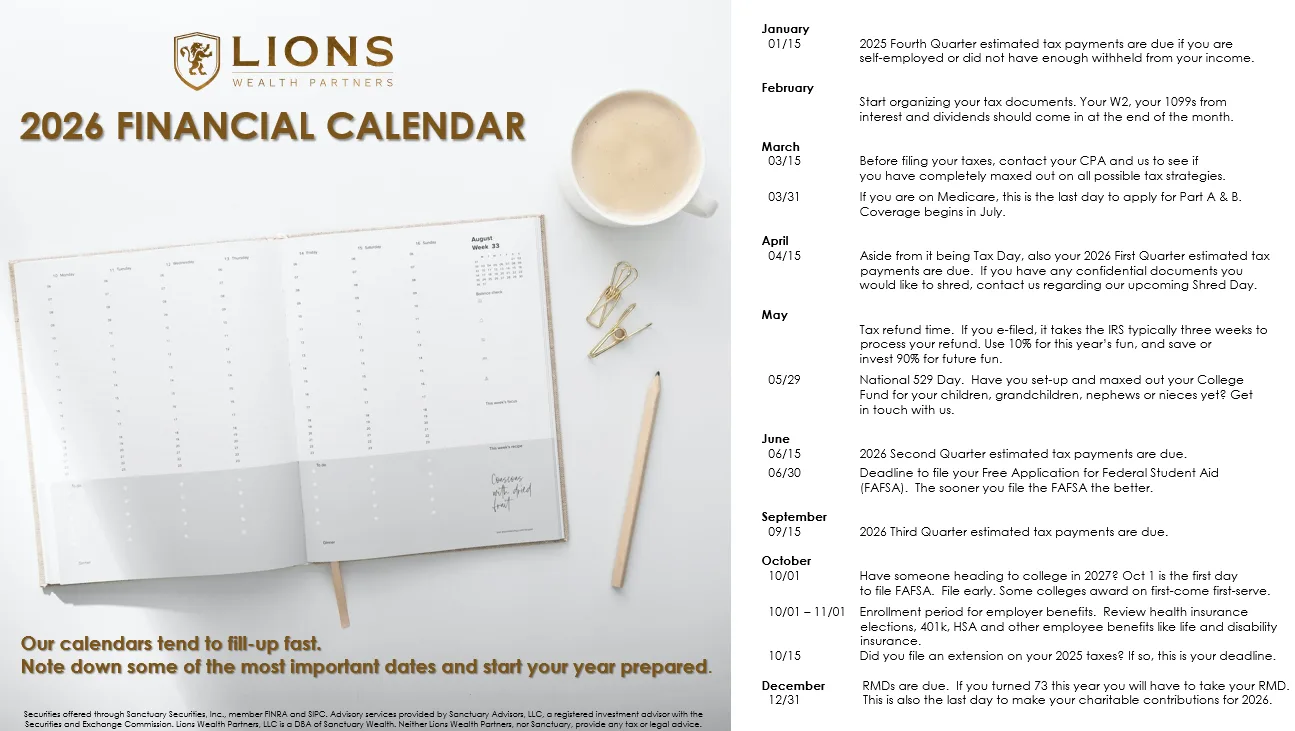

The Lions Wealth | 2026 Financial Calendar

At the beginning of each year, our calendars tend to fill up fast. Accessing the Lions Wealth | 2026 Financial Calendar will allow you to note down important dates throughout the year. From tax deadlines and contribution windows to planning opportunities you don’t want to miss; this calendar keeps you financial “on track” for the…

-

Retiree Viewing Guide: Shows Worth Your Time

Retirement often opens up something many of us didn’t have before…time. And more retirees are treating their screen time with the same care they give to travel plans or reading lists. Whether you’re after thoughtful storytelling, eye-opening documentaries, or something to share with friends, the right show can feel like a new adventure, or at…

-

How to Fire Old Financial Habits

You’ve advanced in your career. You’re earning more and managing the responsibilities that come with success. Yet maybe you’ve maintained some financial habits that you should have left behind. These habits are often rooted in past visions of security or achievement. But if the conditions have changed, it’s worth asking whether the behavior still fits.…

-

Pickleball Like a Pro

Pickleball is booming and not just with weekend warriors. Retired high achievers are trading in golf carts for court shoes and discovering that this isn’t a slow-paced sport. It’s fast, competitive, and addictive. The question is: are your skills sharp enough to keep up? 1. The Gear That Matters (and What Doesn’t) Here’s the deal:…

-

Expand Your Circle in Retirement

When you picture retirement, you probably think of freedom. With more time and fewer obligations, you finally have the chance to relax. What many don’t expect, though, is how retirement changes your social life. The people you saw every day…coworkers, clients, even your favorite barista…may no longer be part of your regular routine. That sudden…

-

The Hidden Cost of DIY Investing

Doing your own investing has never been easier. The tools are accessible. The fees are low. The online resources are endless. But there’s one cost that often gets ignored: peace of mind. 1. Confidence Feels Easy in Good Times When markets are calm and rising, it’s easy to feel in control. A few smart moves…

-

How to Maximize Your Credit Score

For the wealthy, credit scores can feel like a formality. After all, when you have ample liquidity, who’s really checking your credit? Turns out, plenty of people are. Lenders, underwriters, insurers, and even business partners may review your credit as a measure of trustworthiness and financial discipline. And while a high-net-worth can open doors, a…

-

Retirement is About Experiences, Not Purchases

Retirement gives us something incredibly rare: time. Time to reconnect with what matters, explore new passions, and create moments that stay with us. But when it comes to how we use that time – and money – it’s easy to default to things we can buy. Here’s another way to think about it: How can…

-

5 Common Money Arguments

Money can be a sensitive topic for couples—even those who typically communicate well. Over the years, we’ve observed a variety of financial disagreements and we’ve noticed a few common themes. Understanding these frequent arguments can help you navigate your financial relationship with greater ease and harmony. 1. Supporting Adult Children It’s natural to want the…

-

The Pros and Cons of Investing in High-End Watches

Luxury watches have long been a status symbol, but in recent years, they’ve also become a popular investment. While some collectors have made impressive returns, smart investing takes patience, research, and a clear strategy. Let’s look at some of the pros and cons of investing in watches. Pro: Strong Potential for Value Growth Luxury watches…

Uncategorized

Your Next Step Toward Financial Confidence

Experience our approach of integrity and steadfast support.